DETROIT 2016 – WHAT A YEAR SO FAR !

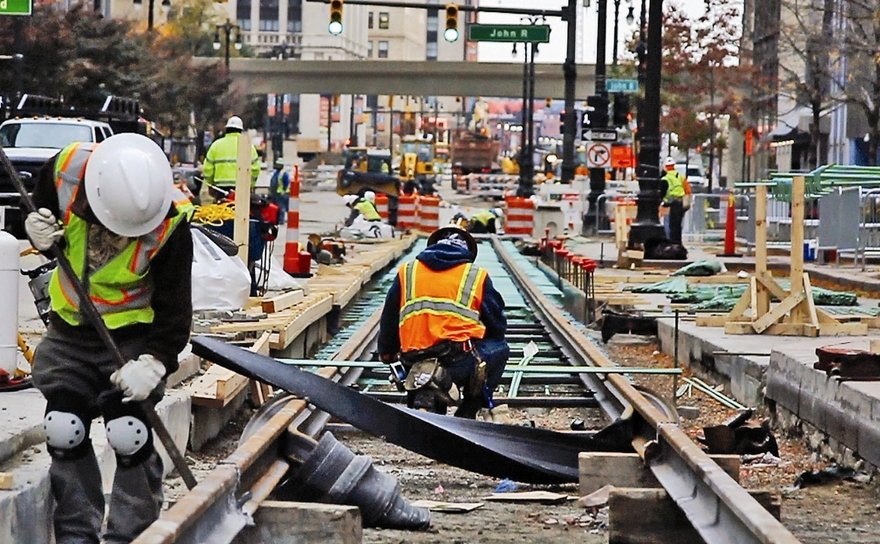

We are just about to enter our third month of 2016 and what a year it has been so far, Detroit again is still proving to be our most popular US investment city. Since the crash many investors have been sitting on the fence, to see how things would pan out. Some investors felt that Detroit had too many issues and variables which created doubt , not just about their return on their present investment but if the future would also mitigate any type of return. If you’ve never been to Detroit and only know what you see in the news, a story about the city’s future could seem confusing, images of derelict buildings and vacant office blocks does not fill an investor with confidence. Negativity always makes great reading but what is really happening, has the city really changed ? is there any positive news ? The answer to this is a very big yes, you have investment taking place all over the city, not just now but over the last few years. A $60 million, nine-story apartment, retail, hotel and conference centre is planned to be erected soon in the heart of Midtown. At the end of 2015 GM announced they were investing $245 million into the Metro Detroit plant. Dan Gilbert, founder of Quicken Loans, has invested more than $1 billion in the last few years, including renovations to Greektown Casino and its highway access ramp. Mike Ilitch, owner of Little Caesars Pizza, the Red Wings and Tigers, is behind the $450-million investment in a new arena and another $200 million to develop the arena district. Chinese development firm DDI Group bought three downtown buildings, including the original Detroit Free Press building, for $16.4 million and is actively scouting further investment in the city. Chrysler added offices downtown, and Fifth Third Bank Eastern Michigan announced it is moving its regional headquarters and 150 full-time employees to downtown Detroit.The ongoing development of the $140 million M1 rail project which is nearly finished and stretches from downtown Detroit to Grand Boulevard in New Centre. The city has been adding things most communities take for granted, such as major grocery stores to support the influx of residents to a city now seen as home of the hipster. Whole Foods, an upmarket organic chain, became the first major grocery store to open in Detroit last year, and Meijer opened a store and is building a second one to open next year. This is just a snippet of the investment that has been taking place in Detroit over the last few years and this has now pushed those investors sitting on the fence to take a plunge. If Billionaires and Chinese Development Groups are buying up properties surely it is time for them ? This increase in demand has led Global to take additional steps to secure the best inventory for our clients, as a company we always rate ourselves as having the best properties at the best prices. We are contacted on a daily basis by real estate companies, private investors and asset management companies asking us to sell their properties. But we have a very strict criteria, we only select the very best properties in Detroit , ones that will provide the best return on investment. We work with more brokers that any other overseas property company, some of them are household names, we now have more than 25 brokers in the Metro Detroit area alone. Not only has our suppliers changed but we also see a dramatic change in what investors want, initially Detroit was all about cheap properties and low capital input. But now investors want properties of higher value, they have more confidence to invest on a bigger scale. Our average sales price has increased to between $30,000-$45,000 whereas two years ago we would of thought these prices would be unachievable. Detroit has a very bright future and Global feels like we were part of the story, we have pushed Detroit over the last few years as we have always felt it was a great investment opportunity and one with great long term prospects for our clients.